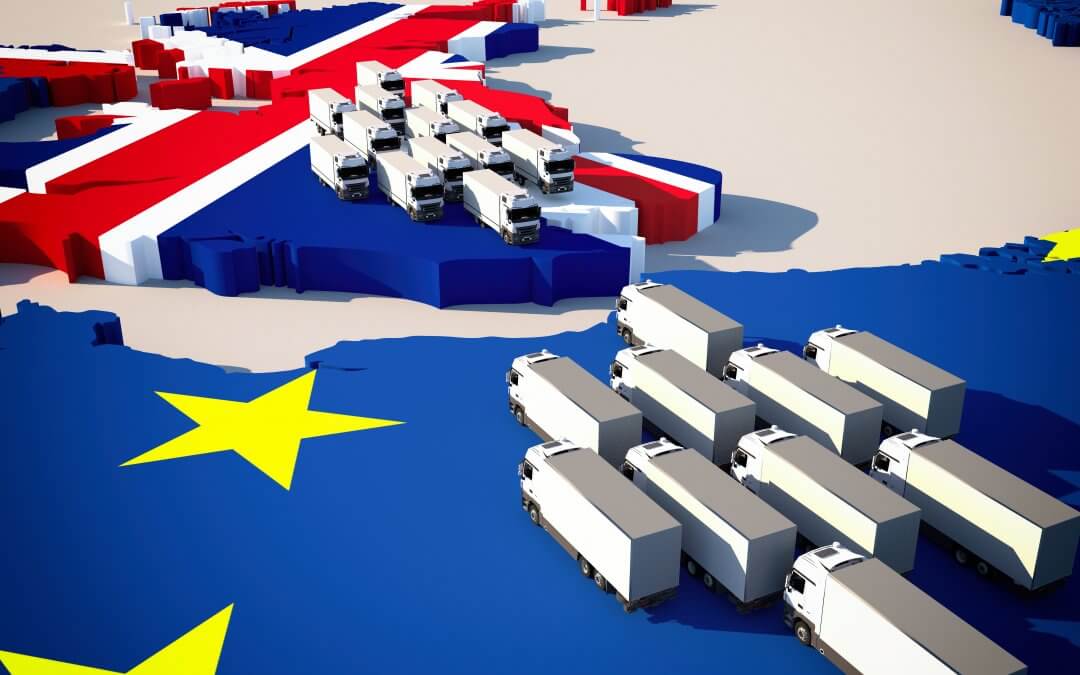

According to the FSB, most small businesses who import from the EU are not prepared for the change of customs controls that are coming on 1st January 2022. According to their poll, a third of the participants were not even aware of the new requirements.

Who is affected?

All businesses that import goods from the EU will be affected by this change to the customs declarations that are changing on the 1st of January 2022.

What’s changing?

Right now, you don’t have to make customs declarations upon arrival of goods imported from the EU, you can defer these declarations to a later date.

As of 1st of January 2022, You won’t be able to delay making customs declarations until after the goods have arrived as you can now.

Customs declarations and payment of relevant tariffs will be required upfront, and all notice of food, drink and products of animal origin must be given in advance.

What can you do if you’re affected?

These changes could lead to a disruption of supply chains for many small businesses in the UK. This means that come the new year, some businesses might not be able to provide their customers with goods and products and could face dire consequences.

One thing small business owners who import from the EU can do is to get someone to deal with customs for you. can do is get someone to deal with customs for you. Many businesses do this to avoid any penalties. You can find out more about what options you have available to you regarding getting someone else to deal with customs on your behalf on the government’s website.

Another suggested option that businesses can do is to speak to their supplier to ensure that you have all you need to make declarations and look for an efficient way forward with the new changes.

For information on the upcoming customs changes, head to the government’s website.