Blog

Welcome to The Formations Company Blog. Here we’ll share the latest news and helpful tips to make starting your business a little easier. Whether you’re looking for information on how to chase an invoice, tax, marketing your business or just looking for inspiration, there’s something here for everyone.

Omicron support for businesses in the UK

The government has issued financial support for businesses in the UK to help alleviate the effects Omicron is having. England Statutory Sick-Pay Rebate Scheme The Government will cover the cost of statutory sick pay for covid related absences...

New COVID guidance and rules for businesses

With new covid rules being implemented across the UK, we thought we’d share all the current guidance that you need to know as a small business in England. Places where face coverings are compulsory As of Friday 10th December, face coverings became...

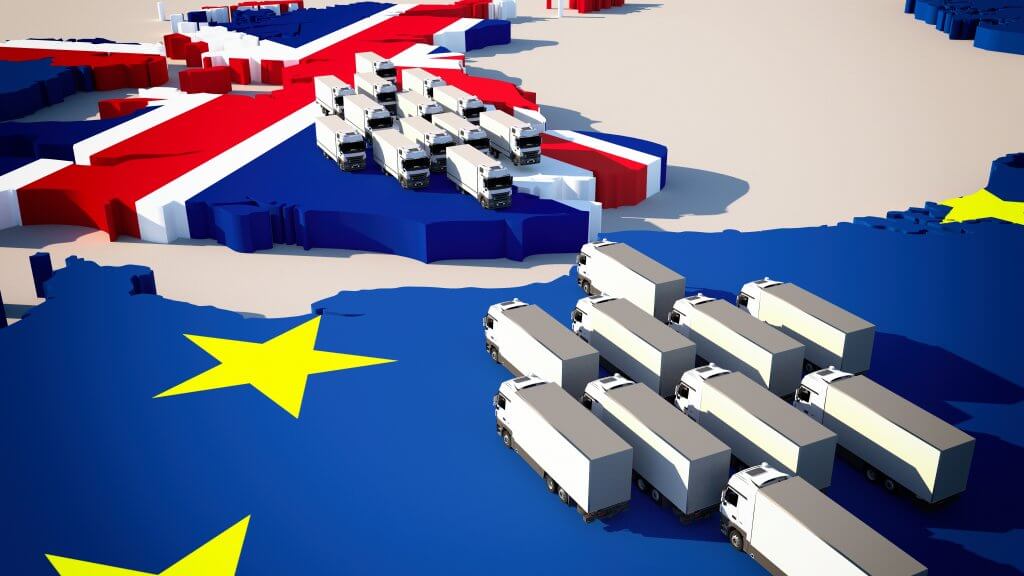

Customs changes 1st Jan 2022 – What you need to know

According to the FSB, most small businesses who import from the EU are not prepared for the change of customs controls that are coming on 1st January 2022. According to their poll, a third of the participants were not even aware of the new requirements. Who...

Making Tax Digital – Changes you need to know as a small business owner

The government will introduce making tax digital to businesses to help reduce the time taken to complete admin, allowing small businesses to focus on their customers, innovation and growth. Who will these changes affect? Businesses that have a taxable turnover...

Being a director of a limited company blog series: Part 10 – Important dates for a director of a limited company

In the last part of this blog series we’ll look at the key dates that as a director of a limited company, you will need to know to avoid any penalties: Key dates for limited company fillings Confirmation statement – This needs to be filed every 12...

Being a director of a limited company blog series: Part 9 – Data protection

Data protection applies to businesses of all sizes, so long as they handle personal data about their customers or employees. Under the Companies act 2006, directors may personally be responsible for breaches in data protection, for example, if a director is aware...

Being a director of a limited company blog series: Part 7 – Paying yourself

An important and exciting aspect of being a director of a limited company is getting paid. As a limited company, this can be very tax-efficient once you’re in profit. Whilst you should always seek professional advice from an accountant when it comes to...

Being a director of a limited company blog series: Part 8 – Contributing to your pension

As a limited company director and owner, contributing to your pension is something that you need to know about as it can have significant tax advantages. State Pension The first point we’ll discuss is that if you pay yourself a salary under the Lower...

Autumn Budget 2021 – What does it means for small businesses?

With the Autumn budget 2021 announcement on 27th October 2021, Chancellor Rishi Sunak set out new financial initiatives and plans that will affect small businesses in the UK. Here’s what happened: Recovery Loan Scheme extended The Recovery Loan Scheme...

Being a director of a limited company blog series: Part 5 – Limited company tax

As a director of a limited company, it’s your responsibility to make sure that your taxes are filed on time. The type and amount of tax you have to pay will entirely depend on your company. We suggest you seek out professional tax guidance when dealing with tax....